Maximising your Tax Deductions | Minimising your Tax Payable

Maximising tax deductions is every business’s/taxpayers’ goal. This is one way you can save from paying higher taxes than you need. But, let’s face it, this is one of the toughest things to do when you are running your own enterprise especially If you don’t know how the Australian Taxation

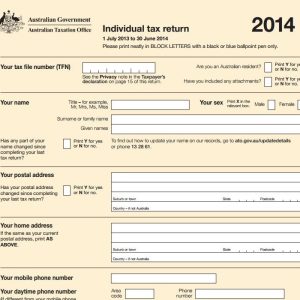

Are you behind in your tax returns?

This article explains to you the simple steps to take to catch up on outstanding tax returns or late tax returns. With the right assistance, you could be up to date with all your refunds within a month 1. Find out how many years of tax returns are overdue Best

Six key requirements for tax compliant invoicing

There are a number of critical parts to your invoicing in order to make sure your invoices are tax compliant. What are the must haves? Ensure the words ‘Tax Invoice’ are prominent Clearly display your full business name and address Your ABN (Australian Business Number) must be on the document

Interest Earned from the bank…

If you have any money in a bank account, more than likely you have earned an amount of interest on your money. This interest is required to be declared in your tax return as part of your Taxable Income for the year. The ATO compares the amount you have declared

Self-Education deductions…

With most universities now back hard at the study and attending classes, it is a great time to look at the available tax deductions for your self-education expenses which you have and will incur into the future. What are Self-Education Expenses? These are expenses incurred in relation to courses provided

Your Most common Tax Deductions…

common deductions to reduce your tax and increase your refund

Company owners get ready for the price hike courtesy of ASIC..

The Australian Securities and Investments Commission (ASIC) has released details of the arrangements to be set in place to recover actual costs in performing their role as a regulator. Their costs for operating expenditure (excluding depreciation and fee-for-service activities) and capital expenditure will be recovered from the areas they regulate

End of Financial Year soon to be here

Another financial year comes to an end it is time to take stock of where you would like to go, where you have come from and the successes you have had throughout the last 12 Months. Look at how you can improve and build on the successes of the past